Any proposal for regulating the price of drugs – even talk of a proposal – can have a negative impact on the amount of money a company invests in pharmaceutical research and development, two business professors say in an article to be published in a prestigious financial journal.

“Pharmaceutical R&D Spending and Threats of Price Regulation” is scheduled to appear early next year in the Journal of Financial and Quantitative Analysis, a journal spokeswoman says.

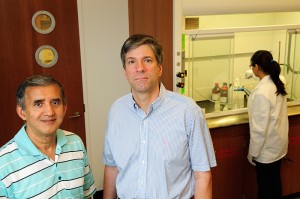

Joseph Golec, an associate professor of finance in the School of Business, began work on the article about five years ago with John Vernon, a former colleague who is now with the National Bureau of Economic Research. Shantaram Hegde, the Business School’s associate dean for graduate studies and professor of finance, joined the project about four years ago.

Unintended Consequences

Hegde hopes their article will stimulate additional research into an important question: How do you make sure that well-intended policy initiatives have desired effects, rather than unintended consequences?

“We don’t want to discourage research and new product and drug development,” Hegde says. “We do want to contain inflation and medical cost, but we don’t want to discourage new product development in medicine.”

In conducting their study, the three scholars posed the question: Do threats of pharmaceutical price regulation affect subsequent research and development spending?

The short answer was yes – big time.

To help answer the question, the Clinton Administration’s Health Security Act (HSA) of 1993 was used as a natural experiment.

“It was a proposal to cap new drug prices. We said that if you let the government regulate prices of drugs and medical products, that would discourage research and development because the price for new drugs would no longer be set in the market place,” Hegde says.

“Even though the HSA was subsequently rejected by Congress, in the roughly two year period following the rejection, R&D spending fell by about $1 billion,” he notes.

Long-Term Effects

“Our main message from the study was that the uncertainty created by these policy initiatives can have long-term adverse effects on R&D, even though some of these policies never become law,” Hegde says. “One has to be careful about coming up with new policy proposals, because even though they don’t ultimately become law, they can have long-term negative effects on research and development.”

Golec says a number of pharmaceutical companies have expressed interest in the study.

“The companies have used some of the data to support their argument that if you restrict prices you’re going to get less R&D,” Golec says. “But this isn’t a new song for them. Congress has heard it so many times, but at least the companies now have some evidence from our study.”

The study linked events surrounding the HSA to pharmaceutical stock price changes, and then examined the cross-sectional relation between companies’ stock price changes and their subsequent unexpected spending changes in research and development.

“We were able to trace some of the behavior of companies and what was going on at the time,” Golec says. “You could see in the FDA filings that there was certainly a decline in the number of R&D projects right around the time of the HSA.”

The study included 111 pharmaceutical firms and looked at how their stock prices reacted to major events, such as threatened government intervention, from January 1992 to July 1994.

“The HSA’s main provision was a cap on new drug prices,” the article says. “As a way to limit political support for the HSA, the major pharmaceutical firms agreed to keep drug price inflation low. Indeed, we show that real drug prices fell sharply in 1993 and remained relatively low afterward. We also find evidence of negative changes in firms’ drug research pipelines in the years 1993, 1994, and 1995.”

“If you look at history, it’s amazing the correlation between 1992 and 2008 and 2009,” says Hegde. “We are going through a similar debate now with President Obama in charge and exploring how to deal with this healthcare inflation. What form it will take we don’t know yet, because there’s a lot of uncertainty as to how the Obama Administration will address healthcare inflation.”

After devoting years to the article, the professors are looking forward to seeing their work finally published in the prestigious journal.

Golec says the Journal of Financial and Quantitative Analysis is one of the top journals in finance. Hegde notes that the journal accepts only 10 percent to 15 percent of the papers submitted.

The paper also recently won recognition from the Business School with an honorable mention in the competition for Best Paper.