When he was a student at Columbia Law School, Steven Davidoff’s interests did not include the field in which he would one day become a national leader: mergers and acquisitions.

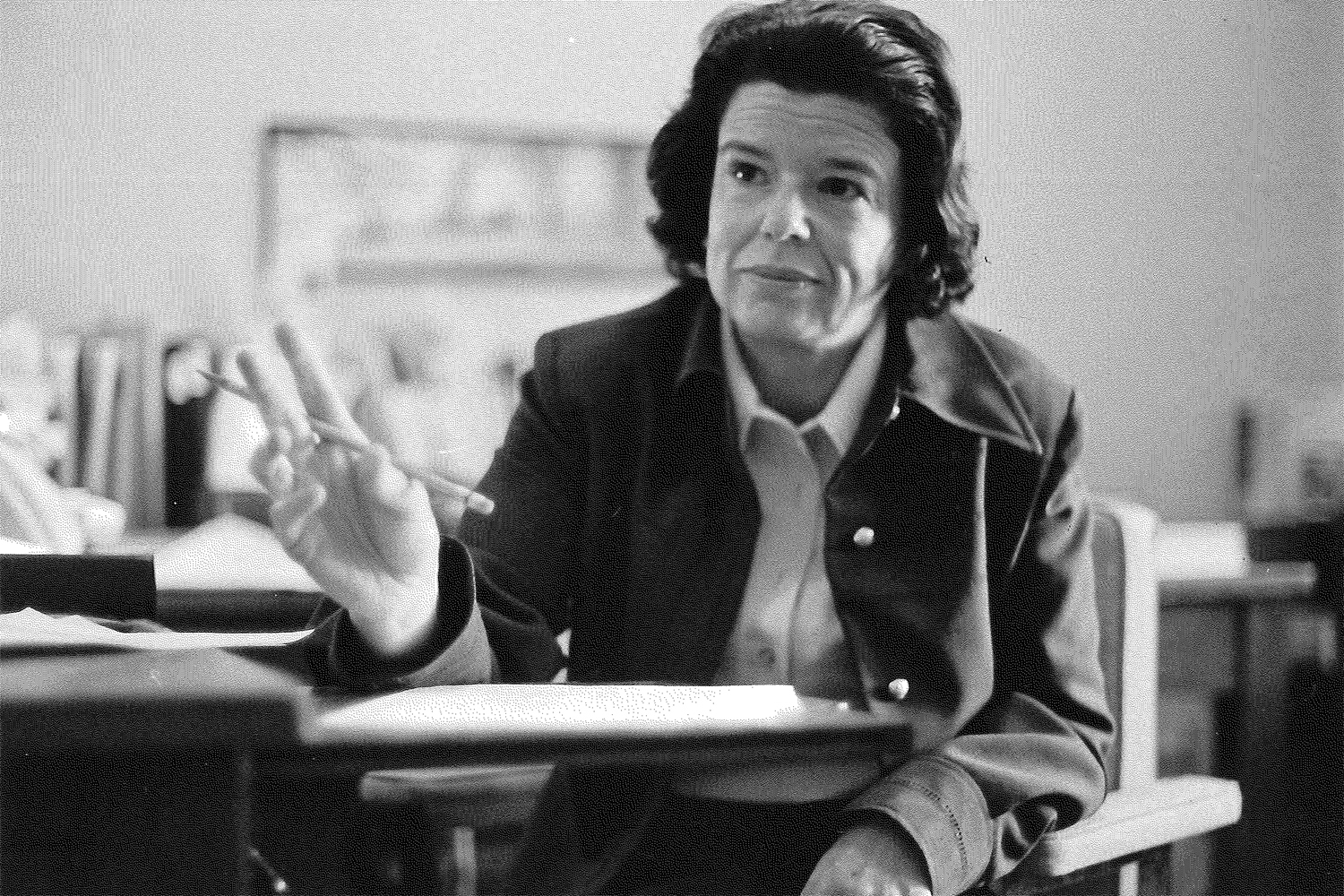

“I had no desire to do corporate law or anything that I’m doing today,” says Davidoff, an associate professor at the UConn Law School and columnist on The New York Times “DealBook” site.

But once he got a taste for corporate law after graduating from law school, he was hooked. Davidoff practiced as an attorney for about 10 years with firms in New York and London. He represented European and U.S. clients in acquisitions and sales of public and private companies, joint ventures, and private equity and venture capital investments.

“This is a very high profile field and a very exciting one to work in,” he says. “There is often a lot at stake, so it’s very intense.”

It was from that perspective that Davidoff saw the rise and fall of the Internet boom.

“Seeing that was a great way to get a lot of experience at a young age dealing with complex matters and having a lot of responsibility,” he says.

But after nearly a decade as a practicing lawyer, Davidoff, who was living in London at the time, decided he was ready for a change.

“I realized that if I didn’t go into academia when I was still relatively young, I never would,” he says. “I’m very happy with that decision.”

So he returned to the U.S. and became a law professor. After teaching at Wayne State and Ohio State, he came to UConn in 2008. And gained a good deal of positive notoriety along the way.

“When you are a young law professor, you want to get your name out there,” he says, “so I started blogging about mergers and acquisitions and the winners and losers they created in the financial world.”

Reporters took notice, and soon Davidoff was being sought-out as an expert in the field and was widely quoted in publications like the Wall Street Journal and TIME Magazine as the financial crisis crept up on the nation. At the end of 2007, Andrew Ross Sorkin – a New York Times business writer and author of the recent book on the financial collapse called Too Big to Fail – asked Davidoff to become a regular contributor to his DealBook website, where Davidoff continues to write as “The Deal Professor.”

“My goal was to make people understand important deals in corporate America, to dig deeper and write for students, practicing lawyers, and average people who want to learn more about mergers and acquisitions and corporate law,” he says. “I’ve found there’s a tremendous hunger for that.”

It was good timing: Shortly after he began writing for the site, banking giant Bear Stearns fell.

“I had a front row seat to the financial doomsday,” says Davidoff, who was talking to many of the central players. “It was one of the biggest events in the past century and I saw what I was doing as a public service – explaining to people what was going on, making sense of the crisis.

“It’s not quite American Idol, but for a law professor, it’s a good platform,” he adds with a laugh. “I have the opportunity to unpeel these deals and take a hard look at them in ways that many people can’t.”

He has a book out on the subject called Gods and War: Shotgun Takeovers, Government by Deal and the Private Equity Implosion.

While the crisis seems to have passed, its aftershocks and what happens next are still at the forefront of the public consciousness.

“We need to look inward,” says Davidoff. “We spent the past decade spending and not saving. Wages have not been rising, interest rates are historically low, and China has been subsidizing our rates in part. What we’ve seen is a great unwinding of these events.

“The economy is going to recreate jobs, but we also have to deal with systemic issues, like our persistent trade deficit. Until we deal with these issues, we’re still going to have global imbalances and a bubble-like global economy.”

He also advocates a reform of the financial sector.

“In corporate law, we’re going to have to have meaningful financial reform,” he says. “What we need to do is make sure that we don’t have people taking undue risks. We’re going to have to build a strong regulatory structure for the whole financial economy, and not leave these black holes like we had before.

“Everyone knows all this,” he adds, “but politically, it’s very hard.”