The University of Connecticut in partnership with Connecticut Innovations (CI) and Webster Bank today announced it is establishing a $1.5 million UConn Innovation Fund that will provide early-stage financial support to new business startups affiliated with UConn.

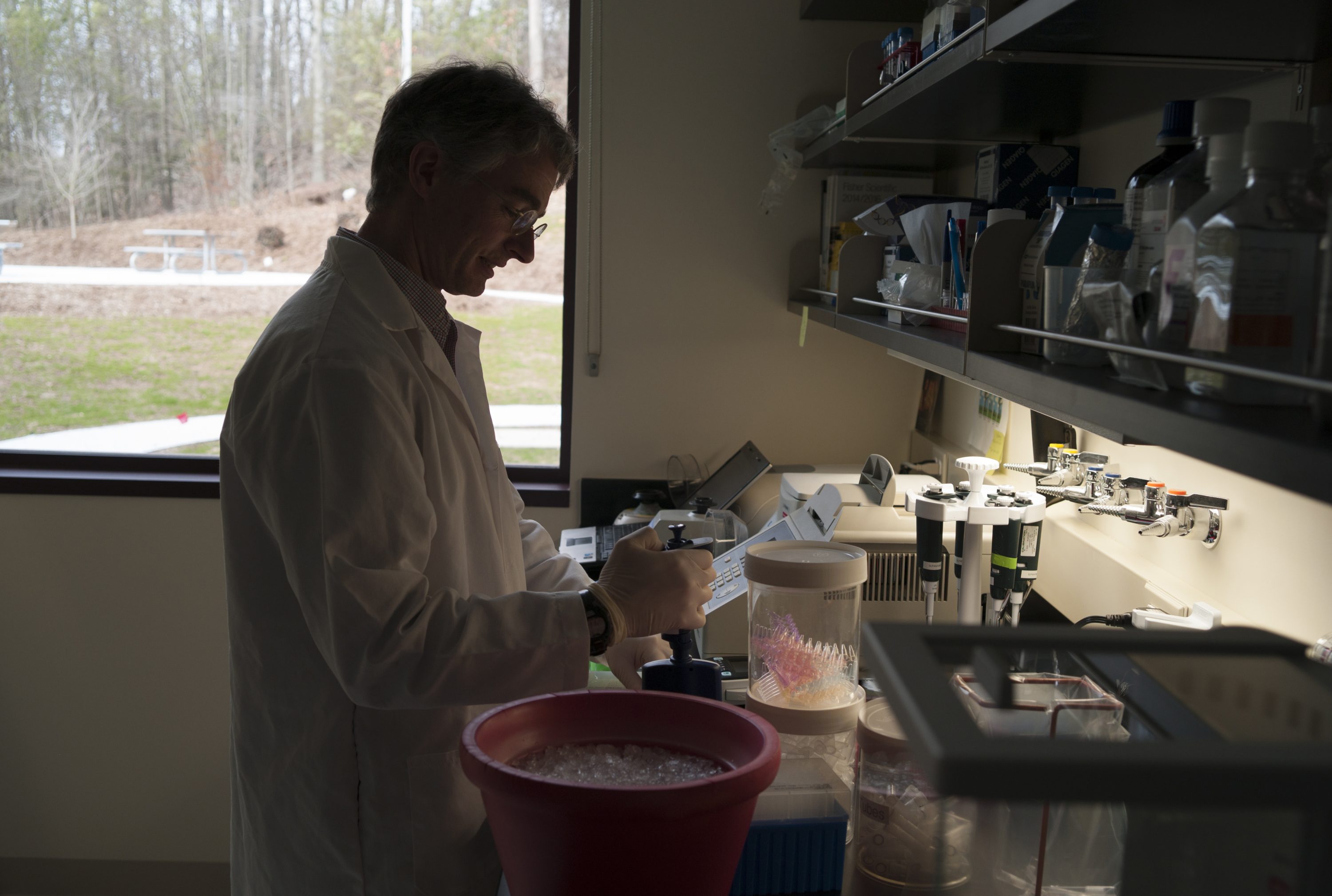

Investments of up to $100,000 are available to any student, faculty member, or alumnus of the university with an in-state business startup tied to research, advanced technologies, or innovations developed at UConn. Companies participating in UConn’s Technology Incubation Program are eligible.

“This fund is designed to provide the important early financial support UConn students, faculty, and alumni need to commercialize new technologies and succeed in today’s highly competitive business environment,” says UConn Vice President for Research Jeffrey Seemann. “We are grateful to have two exceptional partners—CI and Webster Bank—to collaborate with us on this important endeavor.”

UConn faculty and students looking to translate lab discoveries into commercial products and services receive patenting and licensing assistance, business incubator space, financial awards and other support services from the university. The new fund allows Connecticut Innovations – the leading source of financing and ongoing support for Connecticut’s innovative, growing companies – to continue its support of new business startups established through UConn. Webster Bank will provide the key financial and banking expertise needed to help new companies grow.

“We see tremendous growth in the quality and quantity of companies coming from UConn,” says Matt McCooe, CEO of Connecticut Innovations. “We know early-stage funding can be a real challenge for businesses, particularly those coming out of the university setting. We look forward to supporting these entrepreneurs and helping improve their probability of success.”

The UConn Innovation Fund is an investment fund intended to serve as a critical early-stage revenue stream for in-state business startups that will allow them to stay in Connecticut and grow. UConn, CI, and Webster Bank are limited partners and investors in the fund.

“We are pleased to support UConn and Connecticut Innovations in their efforts to grow Connecticut’s entrepreneurial ecosystem,” said Peter Hicks, senior vice president, emerging growth banking group at Webster Bank. “These businesses help make our communities more vibrant by creating jobs that grow and diversify our economy.”

UConn Innovation Fund investments will take into consideration a company’s strength and existing resources, innovative technology, potential for commercialization, and likelihood of obtaining additional external funding among other factors. The Innovation Fund will be managed by a UConn Evaluation Board, fund managers, and an investment committee comprised of representatives from UConn, CI, and Webster Bank.

The first deadline for applications is Oct. 14, 2016. Businesses interested in learning more about the fund should go to: innovationfund.uconn.edu.