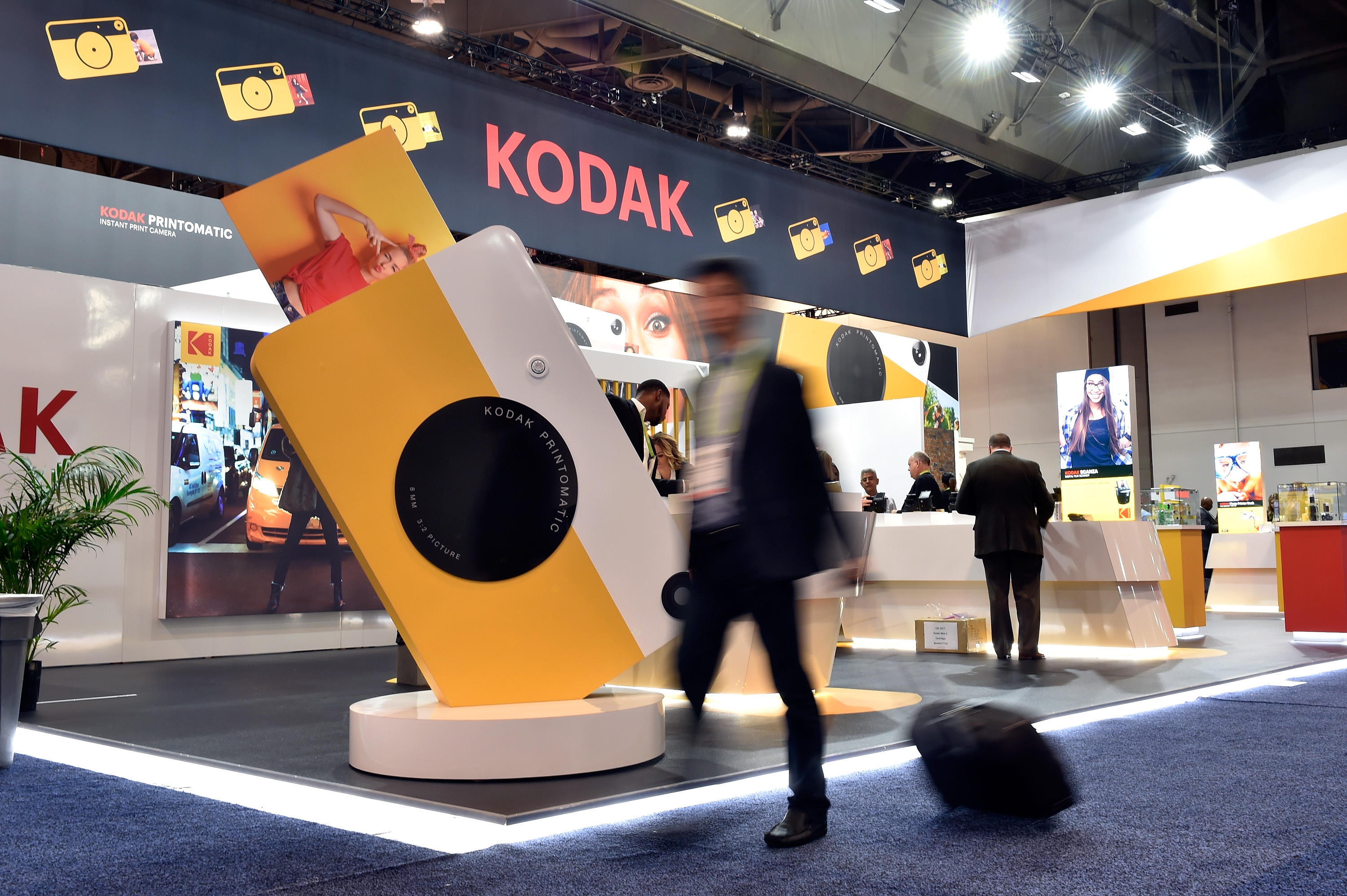

On Tuesday, shares in Kodak surged after the company announced plans to launch cryptocurrency called “KodakCoin” to empower photographers and agencies to take greater control in image rights management. Only a few years ago, the 130-year-old company emerged from bankruptcy with a new focus, but its shares had been steadily declining. What does this indicate about cryptocurrency and what does it mean for the long-term financial health of the iconic photography company? David Noble, director of UConn’s Peter J. Werth Institute for Entrepreneurship & Innovation, has the answers.

Q. For those who aren’t yet familiar with the terms cryptocurrency and blockchain, can you describe what they are?

A. A blockchain is a technical protocol that shares a number of characteristics. Generally, the operation of that protocol is decentralized. The same data is stored across many different parties’ computer assets, as opposed to a relational database where a central party saves all the data and it is owned by them. Furthermore, the visualization of how this all works is an immutable record of data that is saved in “blocks” and time-stamped. The next block refers to the previous block, and a new block is created when a predetermined percentage of the computer power agrees on the “truth,” a process called consensus. All of this makes blockchain an expensive and slow way to store and process data, but it is also incredibly secure.

Cryptocurrency is a digital asset that oftentimes allows you to do certain things, i.e. post data on the blockchain. In the case of [the image rights management platform] KodakOne, KodakCoin is the currency that will allow you to post images for sale, and then others will use those coins to purchase the rights to do things with those images, i.e. include on their website, print for their home, or just look at. Each use could have a specific price, and the smart contract would be able to enforce that use.

Imagine a world where you own the photos you post online, the songs you put into the public domain, and, most importantly, the data you create. — David Noble

Q. What does it say about cryptocurrency that Kodak’s shares would jump by 72 percent within a day of the company’s announcement?

A. It was actually 300 percent as of the time I answered these questions, six hours after you sent them! It says that the fear of missing out on the next best thing is everywhere. Kodak shares represent a way that a lot of institutional investors (who have been dying to get in on crypto) are able to invest in a business stock that is tied directly to a crypto asset. Unlike two other public companies that just changed their names to tie into the mania around blockchain right now, Kodak is going to do an Initial Coin Offering (ICO) to raise the funds to build a product. By the way, no one knows if that product will work. They are just going to try to make it work.

In the blockchain community, there has been conversation about how and when incumbent companies would try to adopt the technology for a while. Goldman Sachs had been seen as a potential first mover, but it makes sense for Kodak, a company that was viewed on a down trend, to make a move in this space.

Q. In a practical sense, what does the increased stock value mean for the overall financial health of Kodak, which only six years ago entered bankruptcy and remade itself?

A. From a practical perspective, it may help on some financial ratios where the market cap or equity is important, interest rates to borrow could be lower, etc. Certainly for executive compensation a higher stock price is very important.

I think where it really helps is on the branding side. At least in the short run, Kodak is suddenly relevant. Every news outlet and investment communication will be talking about Kodak. They have a first-mover advantage in a potentially interesting application, but how their business model will work will be interesting to follow.

Q. Are the issues that Kodak is seeking to resolve with its KodakCoin feasible with this technology?

A. Image tracking and rights management of digital assets is an easy target application for the blockchain. The concept is sound. It remains to be seen if the technology underlying it will work as they intend. If the technology they develop for KodakOne works, then this will create an important change in the dynamics of the digital world. Currently, we create content, and Google, Facebook, Amazon, and to some extent Apple, gobble up almost all of the profits. It is very hard as a content creator to build a business model that works for you.

Blockchain and cryptocurrency built to scale have the ability to change this dynamic. Imagine a world where you own the photos you post online, the songs you put into the public domain, and, most importantly, the data you create. Companies then have to compensate you to use it, or consumers make micropayments to consume it. Google and Facebook are certainly paying attention, as this sort of world represents a massive threat to their legalized monopolies.

Q. If competitors now enter the market with similar plans, will it threaten Kodak’s gain?

A. So Kodak hasn’t built a single product. I don’t know how far along KodakOne is, but if you take them for their word … the funds from KodakCoin will be used to build their platform. Therefore, it is still a wide-open space. With networks, you have an interesting thing. You don’t necessarily need patents to protect your investment, you need a number of network participants. The network effect created protects you. Nobody is creating a direct competitor to Facebook (as Google found out), until there is a significant shift in the technology that enables this effect.

John Bass, the CEO of Hashed Health, once put this concept that we were discussing around blockchains into a very elegant term. A Minimally Viable Network is what a blockchain project needs to be successful, and this is why you always see consortiums, communities, and collaboration in the space. Essentially, a blockchain only works if enough parties on each side of the value equation are using the application together. Once enough parties are on one network, it makes it almost impossible for others to challenge that network, as switching costs protect the network. Now, that doesn’t necessarily mean that the active blockchain will result in a product that is profitable and a company can extract profitable rents from.

This has the potential to revolutionize the core reason for having a corporation. I think that the concept of profit as the main impetus for organizing an entity to deliver value is under attack with blockchain.

The market is clamoring for businesses that they can understand. — David Noble

Q. Are you surprised by the stock market power of cryptocurrency?

A. I’m surprised and I’m not surprised. I find it a bit funny that a lot of the institutions, whose leaders have been speaking so negatively about blockchain and cryptocurrency, are most likely the same ones that tripled the market cap of Kodak over the last few days. With that said, the market is clamoring for businesses that they can understand. Many of the early innovators are working on technology that even the most sophisticated people in business can not understand on a fundamental basis. Also, the stock market wants to believe that blockchain will eventually be used for business purposes that increase the profits of companies implementing it, as opposed to social movements to revolutionize the corporate paradigm.