In Connecticut, a state once known as a hub of the American whaling industry and home to the “Insurance Capital of the World,” UConn economics majors are learning how these two industries intersected in the 19th century through a unique undergraduate research experience.

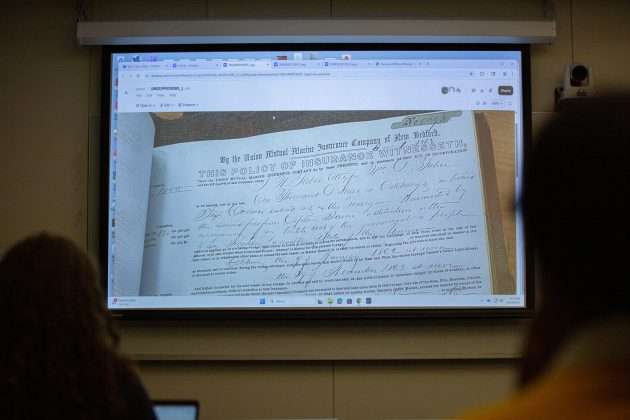

Remy Levin, assistant professor of economics, leads the Historic Risk Lab, which studies risk-taking and insurance in the whaling industry. A behavioral economist who specializes in decision-making under uncertainty, Levin has spent the past two years assembling one of the largest known collections of historical insurance policies from any industry in the 1800s.

Now, he’s opened that archive to undergraduates for a hands-on research opportunity that connects economic theory with real-world application.

“The goal is to use these policies as a lens on the risk-taking behavior of people in the past,” Levin says. “We can’t look inside their heads to see how they were thinking, but we can look at how they priced risk and insured against it.”

Though the insurance materials students are working with are historical, the professional experience and skills they gain are preparing them for their futures.

“What I took away from the lab was the ability to go into an office work setting where you enter data into various spreadsheets and tools, which enhanced my soft skills,” says Owen Hutchins ’25 (CLAS).

Hutchins, a former student in the Historic Risk Lab who now works as an underwriting assistant in the marine department at the specialist insurance company Beazley, credits the lab with launching his career after graduation.

“My experience in the lab and the hands-on experience I gained with marine terminology, even though it’s from a very long time ago, still applies to working in an actual marine insurance agency today,” says Hutchins.

Levin’s students gain a strong skillset in data analysis, archival research, and interdisciplinary collaboration.

“From a data collection and analysis standpoint, I never had the opportunity to do this in a practical environment until I joined this lab,” says Henry Beliveau ’26 (CLAS), who worked in the lab for the 2024-2025 academic year. “It was cool to collect different quantitative and qualitative data to look through and then find trends, because it was something I always learned about but have never done in practice.”

Levin says students learn on multiple levels during their time in the lab. They gain general skills in diligence, time management, and working conscientiously and attentively.

Levin also integrates lessons on whales and scientific material, while teaching students about the underlying mechanics of a research project.

“A lot of students don’t have experience with what the scientific process looks like,” he says. “In research versus learning, you become a producer of knowledge rather than just a consumer of it.”

Claire Flanagan ’26 (CAHNR), an environmental science and environmental and natural resource economics major, says she was excited to find an experience that weaved together her two academic interests.

“I was a student in one of Remy’s classes when he told me about the lab, which seemed interesting because I liked history and wildlife,” says Flanagan. “I’m fascinated by both marine life and economics, and this lab is a great intersection of the two.”

Flanagan and the other students undergo a rigorous training period before they become research assistants, according to Levin.

“I put them through ‘whaling boot camp’ and I throw them into the deep end with coding the policies and see who manages to swim,” says Levin. “After they make it through, I select the best to continue.”

A key aspect of the work involves transcribing and digitizing the 19th-century insurance policies, which are a mix of handwriting and typed text that is difficult to extract using computers, according to Levin. As the undergraduate research assistants work with the policies, they sharpen their attention to detail and gain insight into how modern insurance practices evolved.

Levin says that by connecting students to this history, they see insurance in a new light.

“Insurance turns out to be very interesting, and this is counterintuitive to a lot of people,” he says. “The goal of the insurance industry is to sound boring and steady. As it turns out, insurance companies are just another side of finance.”

For students like Beliveau, contributing to meaningful research has been a defining part of their undergraduate experience.

“The trends that Remy identified were a direct result of our research and the work we were doing, so getting to see that I was contributing to something meaningful and helping results come to fruition was very rewarding,” shares Beliveau.

As students apply their economics knowledge and newly developed professional skills, they’re building a foundation that extends beyond the lab.

“What they’re learning is practical and good for graduate school, and the work all applies to getting a job. Our students apply for jobs across industries, and some even apply for positions as underwriters,” says Levin. “We’re at the home of insurance right here in Connecticut, and a lot of our students go into that industry.”