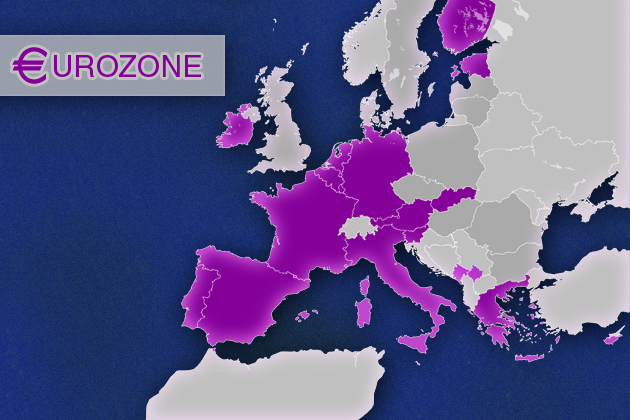

Unsustainable debts threatening several Eurozone countries with financial collapse pose a threat to the U.S. economy as well, according to Olivier Morand, associate professor of economics in the College of Liberal Arts and Sciences.

Morand researches macroeconomics and economic growth, and has been a faculty member at UConn since 1997. He has published journal articles on economic growth and development, among other subjects in economics. He has also been a referee for several journals, including Journal of Public Economics, Journal of Economic Growth, and Journal of Economic Development.

He discussed with UConn Today how the ongoing sovereign debt crisis in the Eurozone may affect the U.S. economy.

Q: The fundamental issue of the Eurozone crisis seems to be the cost of borrowing more than the current size of the debt. Is this true?

A: I would say so. The ratio of debt compared to the output of Greece, Italy, Spain, and several other Eurozone countries is very high, just like it is in the United States. The reason these countries are in trouble is because the cost of borrowing – the “yields” on bonds issued by these countries – has recently gone above 7 percent in Italy and just under 7 percent in Spain. This is similar to the increase on Greek bond yields before they needed a bailout.

Q: What does this mean for the financial systems in the United States?

A: While it is true that several banks in France, Germany, and Belgium have purchased vast amounts of Italian and Greek debt that is now turning bad, it is unclear how much bad debt American banks have acquired in the last few years. However, I do not think that there is a threat of the bad debt contagion spreading to banks in the U.S.

Q: Will the debt crisis in the Eurozone affect the United States economy in any other way?

A: The main thing the United States has to watch out for in the short term is a drop in a demand for our exports. As a whole, the Eurozone is the largest trading partner of the United States – even more so than China. Unfortunately for businesses in the United States, the Eurozone is expected to grow at most by one half of a percent over the next year.

This will lead to a drop in the demand for American goods that are shipped to the Eurozone. For example, think of the drop in demand for U.S. goods from European households, or even the drop in demand for cars produced by Ford in Europe. U.S. companies that have a significant market share in Europe are most likely to be affected. On top of that, the dollar will gain value against the Euro, which will make our exports more expensive for consumers in the Eurozone.

Q: What do you think will happen next in the Eurozone?

A: I think Greece’s debt problem is mostly financial. Italy, however, has a financial and political problem. Of course another big factor is that Italy is a huge economy compared with Greece. It is the third largest economy in the Eurozone and the eighth largest in the world. This will most likely end up in a bailout of Italy, similar to how Portugal, Ireland, and Greece have been bailed out.

This means that many banks in Europe will be in trouble. Several have already agreed to cut the value of their Greek bonds in half as part of the bailout package. While it is a big cut, the alternative for them was losing almost all value on the bonds they held. I think the German and French governments will have to step in to help rescue several banks, although I do not think they will fully nationalize them. Lastly, there is an element of uncertainty, because there is a good chance the ruling party will change in France, so you never know.

Q: Will this lead to any long-term changes in the American banking industry?

A: I think we will see a reform of banks, especially calls for increased transparency in the way they do business. Things like their exposure to debt especially will be subjected to more scrutiny.

Contact information for members of the media:

Olivier Morand, associate professor of economics

College of Liberal Arts and Sciences

Phone: 860-486-3546

Email: olivier.morand@uconn.edu